GORDANO VALLEY CIRCUIT – RISK MANAGEMENT POLICY

The Circuit accepts the Jesus principle that, as His disciples, we cannot be averse to risk for the sake of the Gospel message. We also declare that human and material resources are precious in God’s sight and that this requires risk assessment in our daily activities to ensure that we are providing protection of people and deployment of our resources that gives glory to God.

- The Methodist Church’s Risk Management Policy for the Connexion identifies 5 different Risk Categories as follows:

- Strategic Risks e.g. inappropriate organisation structure; lack of relevant skills; conflicts of interest.

- Operational Risks e.g. poor staff recruitment and training; data loss due to insecure device management; inadequate IT firewall protection.

- Financial Risks e.g. inadequate reserves and cash-flow; lack of accounts scrutiny which could conceal fraud; errors or omissions in transactions that are not identified and acted upon.

- External Risks e.g. changing of government policy; turbulent economic or political environment; bomb threats.

- Compliance Risks e.g. acting in breach of Trust; poor knowledge of legal responsibilities; poor knowledge of regulation and procedures.

- The Circuit Meeting in the transaction of its business will incorporate risk assessment as appropriate in relation to each of the above categories together with:

- Personnel Risks e.g. the health and well-being of ministers and employees: appointment, training, supervision and health and safety.

- Risks to reputation of Church and Circuit e.g. poor practice in safeguarding; lack of clarity in media/press projection

- Responsibility for Risk Assessment

While in particular instances risk management is delegated to members of the Circuit leadership team the Circuit Meeting has ultimate responsibility for risk and is expected to regularly review and assess the risks to the Circuit in all areas of its work.

- Risk Assessment

| Risk Category | Actions include |

| 1. Strategic | Strategic planning by Circuit Meeting and Leadership Team; Review of activity focus; Regular reports to Circuit Meeting; Review of personnel structure and responsibilities; Discussion with District, Connexion and other Circuits re means to minimise strategic risks. |

| 2. Operational Risks | Planning for stationing; Consistent recruitment policy and practice for lay employment appointments; Review of operational structure; Identification of training needs; IT and office management Review. |

| 3. Financial Risks | Treasurer’s reports to Circuit Leadership and Circuit Meeting; Annual Report; Auditing of Accounts Review of Annual assessment Establishment of Resources Committee Appointment of financial clerk |

| 4. External Risks | Response to Connexional and District advice; Challenge to Connexion and District re good practice and a culture of ownership; Security of churches alert/risk assessment. Review of mission practice in the context of secular society. |

| 5. Compliance Risks | Attention to Constitutional Practice and Discipline of the Methodist Church. Reference to Safeguarding, Employment, Data protection, Government and Charity requirements. |

| Access to professional advice [See: Appendix 2] | |

| 6. Personnel Risks | Compliance with good employment practice [See Policy for Employment of Lay Workers] and Guidance Risk Assessment for Lone workers. |

| 7. Health Safety and Welfare | Compliance with Fire and evacuation regulations in church buildings. Adherence to workplace health, safety and welfare regulations. Expectation of individual church awareness and management of health and safety including publication of awareness notices and risk assessments of buildings and activities. |

| 8. Reputational Risks | Awareness by all of the need to behave and speak within the ethical and substantive norms of Christian living. The promotion of ‘positive’ messages and ‘good news’ relating to the Circuit/churches’ activities. Adoption of Media Policy for managing adverse publicity. |

- Risk Reporting

It is expected that all members of the Circuit Leadership Team and the Circuit Meeting will play an active part in identifying potential risks to the organisation and reporting these to the Superintendent Minister or Senior Circuit Steward.

There is an expectation that such potential risks will be assessed and evaluated by the Circuit Leadership team with proposed actions to be taken to minimise risk

Risk Governance

| Circuit Meeting | Provides policy, oversight and review of risk management |

| Circuit Leadership Team | Drives culture of risk management and initiates and oversees reviews of risk management. |

| Senior Circuit Steward | Continuously improving risk management policy, strategy and supporting framework |

| Church Councils | Require church members comply with the risk management policy and foster a culture where risks can be identified and escalated |

| Ministers, Employees, Church Members | Comply with risk management policies and procedures |

- Risk Appetite

It is recognised that taking risks is vital when seeking to communicate the

Gospel and that the Methodist Church was founded because of risks taken by John Wesley. It is policy to embrace risks which aim to advance the purposes of the Gordano Valley Circuit Methodist Church whilst ensuring those risks that might have a negative impact must be avoided or minimised.

| Key Drivers of the Organisation | Risk Appetite |

| The Gordano Valley Methodist Circuit mission is to encourage and enable people of all ages to become followers of Jesus Christ, and to learn and grow in the Christian faith. | |

| Health, Safety and Welfare (inc. safeguarding) | Zero |

| Maximising staff potential | Medium |

| Achieving Financial Plan and funding targets | Low |

| Leading high quality worship which engages all | High |

| Exploring new forms of mission and outreach including community support | Medium |

| Compliance with legal requirements | Zero |

| Working with others in partnership | Medium |

| Maintenance and management of property in its remit | Medium |

- Risk Appetite Descriptors

| Assessment | Description of potential effect |

| Very High Risk Appetite 5 | accepts risks that are likely to result in reputation damage, financial loss or exposure, major breakdown in services, information systems or integrity, significant incidents of regulatory and / or legislative compliance, potential risk of injury to staff / service users. |

| High Risk Appetite 4 | willing to accept risks that may result in reputation damage, financial loss or exposure, major breakdown in services, information systems or integrity, significant incidents of regulatory and / or legislative compliance, potential risk of injury to staff / service users. |

| Moderate Risk Appetite 3 | willing to accept some risks in certain circumstances that may result in reputation damage, financial loss or exposure, major breakdown in services, information systems or integrity, significant incidents of regulatory and / or legislative compliance, potential risk of injury to staff / service users. |

| Low Risk Appetite 2 | not willing to accept (except in very exceptional circumstances) risks that may result in reputation damage, financial loss or exposure, major breakdown in services, information systems or integrity, significant incidents of regulatory and / or legislative compliance, potential risk of injury to staff / service users. |

| Zero Risk Appetite 1 | not willing to accept risks under any circumstances that may result in reputation damage, financial loss or exposure, major breakdown in services, information systems or integrity, significant incidents of regulatory and / or legislative compliance, potential risk of injury to staff, service users or public. |

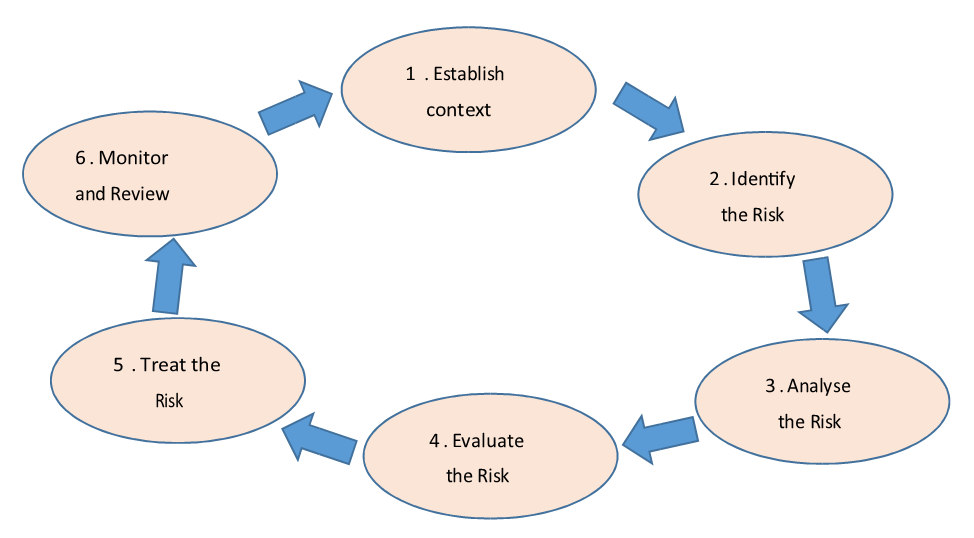

- Risk Management Process

The procedures for assessing risk management will have the following components: